how does zillow calculate property tax

When it comes to selling a home the assessed value is the most widely accepted dollar value of. So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in taxes per year.

The assessed value is a propertys determined valuation to calculate the appropriate tax rates.

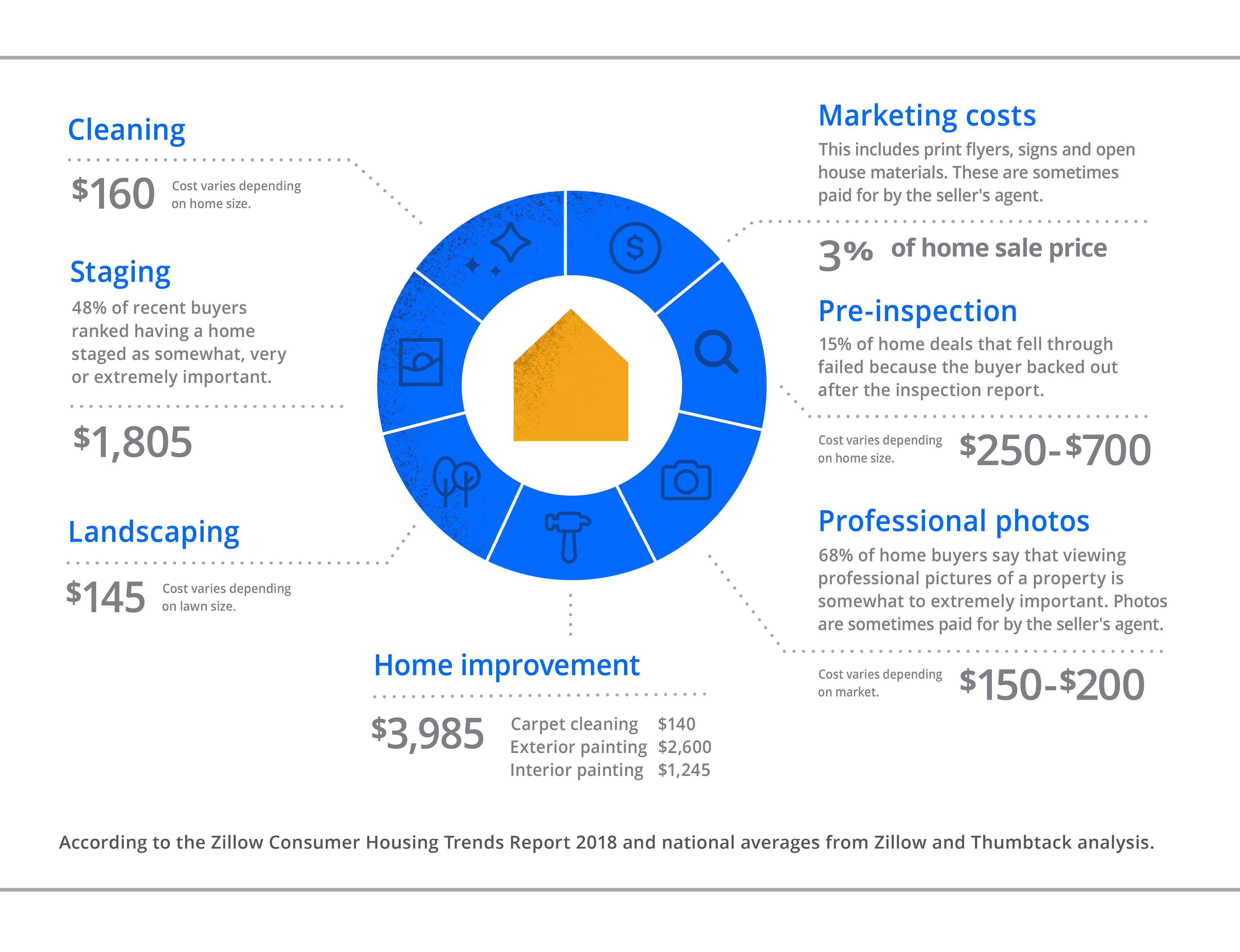

. States with highest effective property tax rates. But the county rate and the town rate found elsewhere online put the property tax rate at 148 or 168. It takes into account the true costs of selling a home like repairs and staging needed to help a house put on its best face for buyers agent commission and closing fees to tell you how much it will cost to sell your home and how much youll put in the bank when its.

To calculate the property tax the authority will multiply the assessed value of the property by the mill rate and then divide by 1000. Net proceeds are profits youll walk away with after the sale of your home. Your estimated annual property tax is based on the home purchase price.

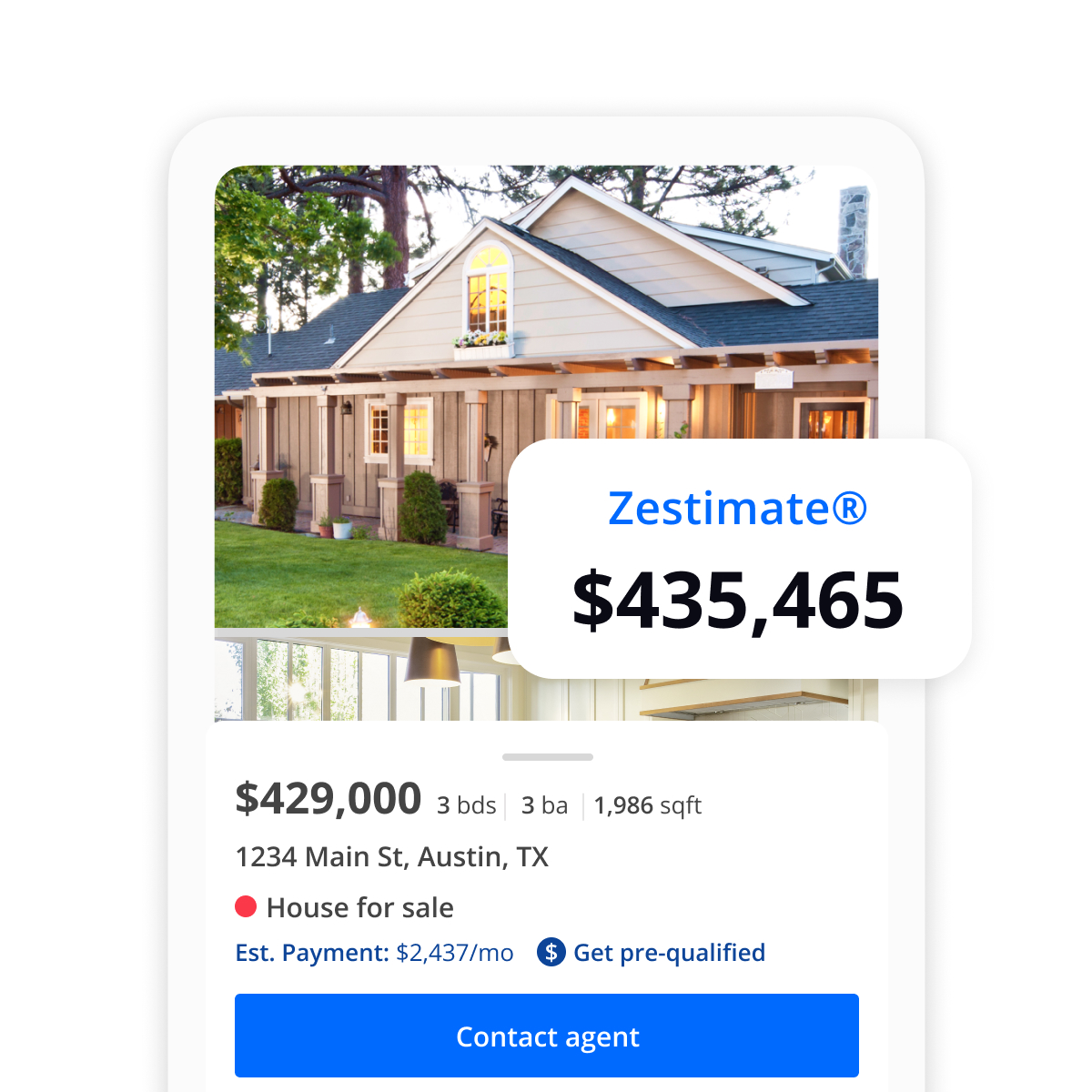

For example a property with an assessed value of 50000 located in a municipality with a mill rate of 20 mills would have a property tax bill of 1000 per year. The Zestimate is calculated through a Zillow algorithm that crunches data from public property records tax. If the sellers had relied on the Zillow estimate they would have lost more than 100000.

This flawed formula can lead to an inaccurate Zestimate of tens of thousands of dollars and in some cases hundreds of thousands. Understanding the Net Proceeds from Your Home Sale. Zillows Home Sale Proceeds Calculator can estimate how much profit youll make from selling your home.

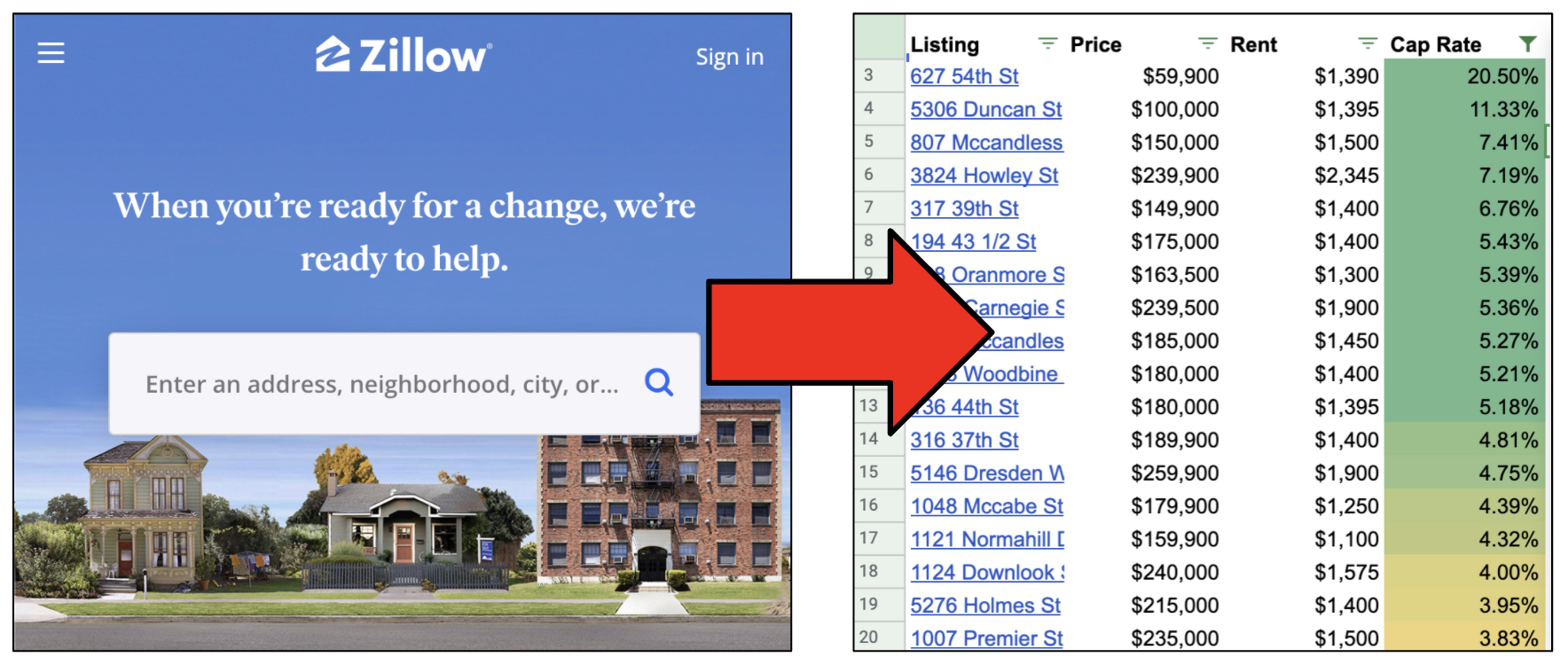

Updating your home details. Zillow valued that home at 983097 yet it sold at 1085000 which was 10 more than the Zillow estimate. Then divide the total return by the cost of investment to calculate the rental property ROI.

Heres a quick summary of the highest and lowest property tax states. An assessment considers sales of similar homes as well as home inspection findings in its final determinations. First calculate the return on investment by subtracting the total gains from the cost.

A huge component in Zillows formula is assessed the home value or the value placed on a property for tax purposes which is usually only around 20 of the fair market value of the home. What does tax assessed value mean. Property taxes are calculated by taking the mill levy and multiplying it by the assessed value of the owners property.

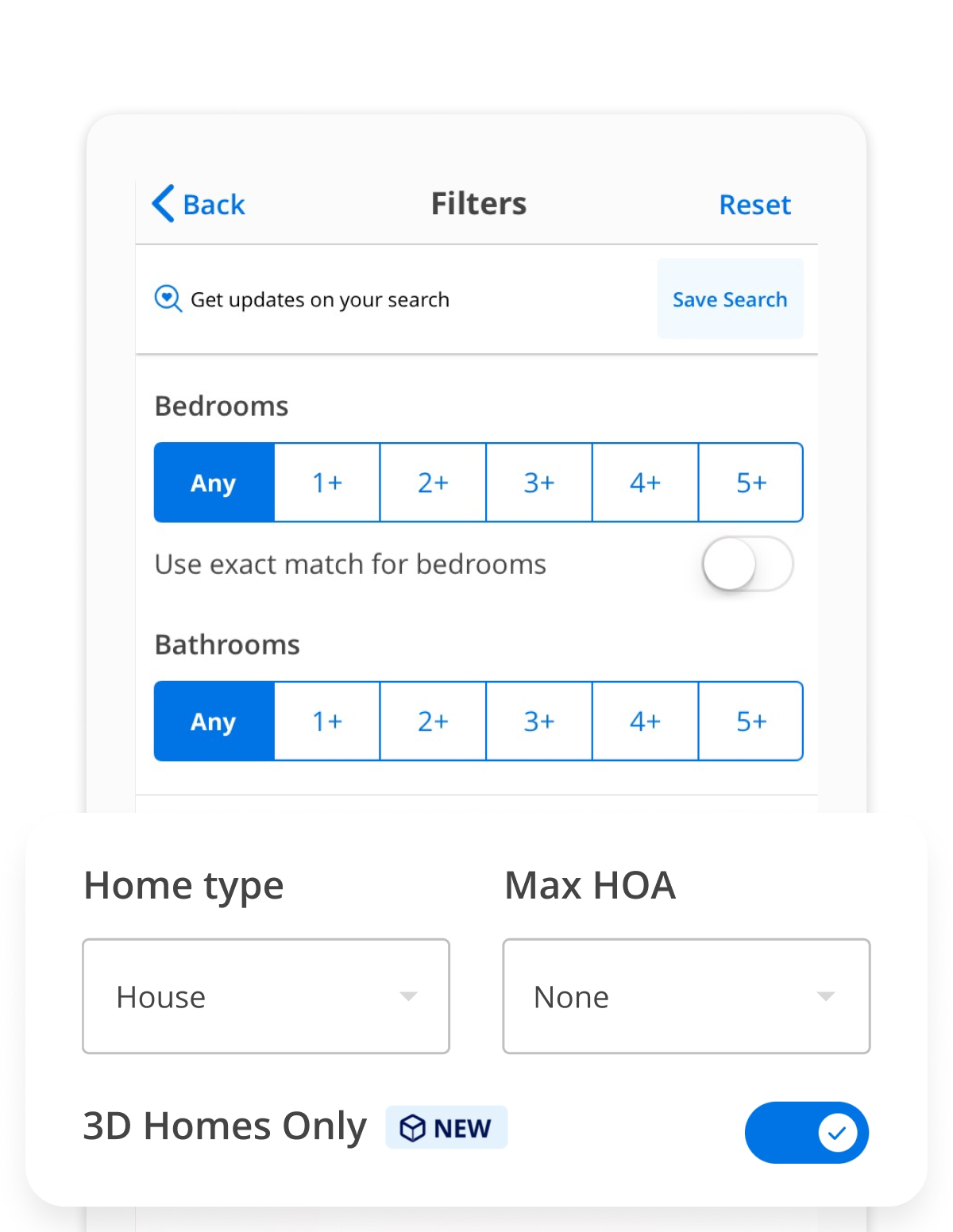

States with lowest effective property tax rates. For example they will use the number of bedrooms baths the square feet of living area and other property data points to figure out property values. Like other similar tools Redfin and Zillow calculate a homes estimated value using publicly available data like tax records recent property sales and local market trends.

A tax assessment determines the value of a piece of real estate. The Zestimate also incorporates. It says the property taxes last year were 2480 on an assessed value of 68650.

The property tax rate can vary based on the state where youre selling. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. I found a house that is listed at 170k.

Home characteristics including square footage location or the number of bathrooms. Assessed value of property determines its property taxes while appraised value is an appraisers opinion of property value that may be similar to its fair market value. Learn more about the home sale calculator line items to understand the true costs of selling a house and your realistic proceeds.

A Zestimate is Zillows estimated market value for a home computed using a proprietary formula including public and user-submitted data such as details about a home bedrooms bathrooms home age etc location property tax assessment information and sales histories of the subject home as well as other homes that have recently sold in the area. Where to find property taxes plus how to estimate property taxes. The total is divided by 12 months and applied to each monthly mortgage payment.

To calculate the property tax the authority will multiply the assessed value of the property by the mill rate and then divide by 1000. If you know the specific amount of taxes add as an annual total. That works out to a property tax rate of more than 36.

Property tax rates by state. To calculate a Zestimate Zillow uses a sophisticated neural network-based model that incorporates data from county and tax assessor records and direct feeds from hundreds of multiple listing services and brokerages. Tax assessment is usually conducted by a government assessor who uses the assessed value of a property to calculate the amount of tax due on it.

How to calculate ROI on rental property. Home details like square footage location and the number of bedrooms and bathrooms. If its accurate a propertys asking price should approximate its market assessed and appraised values.

The third home was a reconstructed home in an exclusive area of Davis California near the University of California Davis. The assessed value estimates the reasonable market value for your home. Regardless of the type of home you own you can expect to pay property taxes.

Zillow uses a proprietary formula to determine the value of a property based on information the website has obtained from public records and information entered by users.

Where Does Zillow Get The Price And Tax History Data For My Home Zillow Help Center

How To Scrape Zillow For Free Without Writing Code Fortune For Future

First Time Homebuyers Should I Rent Or Buy Purchasing A Home Is An Important Decision And Has Major Rent Vs Buy Buying Your First Home Renting Vs Buying Home

How Much Does It Cost To Sell A House Zillow

The Do S And Don Ts Of Using Zillow The Reluctant Landlord Being A Landlord Zillow Selling House

Is Zillow Showing You The Wrong Monthly Payment Youtube

Nearly 10k A Year Taxes Insurance Other Homeowner Costs Zillow Research Homeowner Homeowners Insurance Insurance

Free Rental Income And Expense Worksheet Zillow Rental Manager

Property Taxes Definition Zillow

What Is Dti Debt To Income Ratio Zillow Debt To Income Ratio Debt Debt Ratio

How To Find A House On Zillow With Advanced Search Techniques Zillow

35565 Little Walluski Ln Astoria Or 97103 Zillow

What Is Escrow And How Does It Work Zillow Home Buying Home Improvement Projects Home Values

How To Find A House On Zillow With Advanced Search Techniques Zillow

What Is The Average Time To Sell A House Zillow Selling Your House House Styles Things To Sell

/x_reasons_zillow_estimates_are_not_as_accurate_as_you_think-5bfc3429c9e77c002631fd3e.jpg)